Business Office

Treasure Valley Community College's Business Office is committed to providing exceptional service to our students, staff, faculty, and community partners. 威尼斯人娱乐城 's Business Office includes the Accounts Payable, Accounts Receivable and Human Resources Departments.

- Accounts Payable is responsible for processing purchases including purchase orders, requisitions, and vendor payments.

- Human Resources handles all employee management functions including finding, hiring, training, and supporting new employees as well as providing benefits, services and programs to enhance the quality of life for our employees.

- Accounts Receivable(A/R) is responsible for billing and incoming payments for both our students and community partners. A/R also handles holds, collections, and processes tax documents for our students.

Release of Information:

The Family Educational Rights and Privacy Act (FERPA) (20 U.S.C. § 1232g; 34 CFR Part 99) is a Federal law that protects the privacy of student education records. The law applies to all schools that receive funds under an applicable program of the U.S. Department of Education.

FERPA gives parents certain rights with respect to their children's education records. These rights transfer to the student when he or she reaches the age of 18 or attends a school beyond the high school level.

Generally, schools must have written permission from the student in order to release any information from a student's education record. (This includes account balances)

While 威尼斯人娱乐城 understands that many parents may be making the tuition payments, we are not allowed to disclose account information to parents without consent from the student. Students can fill out a Release of Information form in their student portal here. This release of information can be as limited or broad as the student chooses. Students can also send an invitation to pay through their my.tvcc account.

威尼斯人娱乐城's Accounts Payable department is committed to serving our community partners. Your understanding and compliance with the procedures below will allow vendor invoices and reimbursements to be processed in a timely and efficient manner.

Message to Vendors: For prompt payment of your invoices, we request you please submit all invoices to:

Treasure Valley Community College

Accounts Payable

650 College Blvd

Ontario, OR 97914

or you can email invoices to accountspayable@2fitfashion.com. If you have any additional questions regarding payments from 威尼斯人娱乐城 please contact our AP Clerk at (541) 881-5843 or accountspayable@2fitfashion.com. Treasure Valley Community College requires a current W-9 for vendor payments. Failure to include a W-9 for new vendors will delay payment.

Check Distribution: Approved invoices, direct pays and travel reimbursements are processed once a week. ACH (direct deposit) payments are processed on Wednesdays. Funds may take up to 3 business days to reflect in your account. If you are expecting a deposit, please check with your banking institution first to ensure funds are not on hold or pending. Paper checks are processed every Wednesday. All checks, including vendors, employees, and independent contractors and consultants, will be mailed to the address printed on the check. It is highly recommended vendors are set up for ACH payments. Accounts Payable will not hold checks or allow employees to pick up for distribution to the vendor.

**If checks must be printed outside the normal processing schedule, the department must provide the AP manager with a written explanation why a manual check is required. **

Stop Pays/Voids/Reissues: Upon request a check will be cancelled if the check is lost or not received within 15 days from the check issuance date. Cancellation will apply if a check contains an incorrect payee (misspelled, etc.) All Treasure Valley Community Checks are void after 90 days. 威尼斯人娱乐城 is not responsible for any fees incurred for attempts to cash a check after the 90-day void period.

Our Accounts Receivable department is responsible for billing and incoming payments for both our students and community partners. Our student accounts manager is here to help students navigate the billing and payment process. Make an appointment today so we can say yes to your success!

Statements and Making a Payment:

Account Statements are mailed out monthly approximately two weeks prior to payment due dates for the current term. 威尼斯人娱乐城 also sends a campus wide email to students informing them that statements are being sent to their address on record. Your statement is always available through your My威尼斯人娱乐城 student portal.

For help understanding your account statement or tuition costs, please visit the links below:

HOW TO PAY: Here at 威尼斯人娱乐城 we have made it easy and convenient to pay your balance.

-

-

-

PAY NOW: Payment is due at time of registration:

-

-

-

-

-

- Make a payment through your My威尼斯人娱乐城 portal.

- Pay by Credit Card by calling Student Services at (541) 881-5815*

- Pay at either of our locations, in Student Services with check, money order, cash, or card.

- Mail a check or money order to: Treasure Valley Community College, Attn: Accounts

Receivable, 650 College Blvd., Ontario, OR 97914

- PAY LATER: 威尼斯人娱乐城 allows students to break up their tuition and fee payments into three convenient payments per term (two for summer). There are two ways to take advantage of our payment plans.

-

-

-

-

-

- Sign up for automated payments through your portal.

- Manually make your payment on the payment due dates listed in our Academic Calendar in one of the following ways:

- Pay by Credit Card by calling Student Services at (541) 881-5815*

- Pay at either of our locations, in student services with check, money order, cash, or card.

- Mail a check or money order to: Treasure Valley Community College, Attn: Accounts Receivable, 650 College Blvd., Ontario, OR 97914

-

-

*There is a 3% processing fee for all card transactions Please indicate account name and Student ID number on your remittance. Receipts will be issued only on request*

PAST DUE BALANCES:

Students with past due balances will have a hold placed on their account and are not

permitted to register for a subsequent term except under special circumstances. Past

due balances are subject to placement with a collection agency. Prior academic year

charges cannot be paid with current academic year Federal Student Aid due to Title

IV Regulations.

If you have a past due balance, it's not too late!! Please call our Student Accounts Manager at 541-881-5810 to make payment arrangements.

Tax Information:

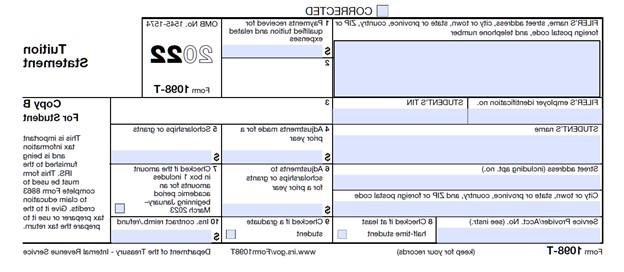

The IRS Form 1098-T is provided to eligible 威尼斯人娱乐城 students by January 31 of the previous

calendar year, as required by the IRS, to provide information that may assist you

in completing your individual tax return. The information listed on IRS Form 1098-T

may be different than the amount you actually paid towards Qualified Tuition and Related

Expenses (hereafter known as QTRE). We strongly recommend seeking professional assistance

when claiming an education tax credit. Regardless of the information provided on

the 1098-T, if you choose to claim an education tax credit, you should always keep

documentation such as invoices and receipt of payment that supports any claimed tax

credit even if you report only what is on IRS Form 1098-T.

Understanding your IRS 1098-T Form

-

- The IRS Form 1098-T is an information form filed with the Internal Revenue Service.

- The IRS Form 1098-T that you receive reports amounts paid for QTRE, as well as other related information.

- You, or the person who may claim you as a dependent, may be able to claim an education tax credit on IRS Form 1040 for the QTRE that were actually paid during the calendar year.

-

-

- Box 1: Shows the total payments received by the College during the calendar year from any source for QTRE minus any reimbursements or refunds made during the calendar year that relate to those payments received.

- Box 2: Reserved for Future Use.

- Box 3: Reserved for Future Use.

- Box 4: Shows any adjustments made for a prior year for QTRE that were reported on a prior year Form 1098-T.

- Box 5: Shows the total amount of all scholarships/grants disbursed to the student account during the calendar year, regardless of the term.

-

Holds and Collections:

-

- Holds: Accounts Receivable (A/R) holds will be added twice per term and prevents registration for future terms. Initial holds are placed after the second payment due date and prior to advising day for all accounts for which no payments have been received or financial aid disbursements made. Holds are placed on all accounts with a remaining balance due after the final payment date of the term.

- Removal for Non-Payment: Treasure Valley Community College will remove students from their registered classes when the student has not completed financial arrangements on schedule or has an outstanding balance from a previous term. Although some may view this action as an inconvenience, it protects students from incurring financial liability if they are not attending classes. Students may re-register for classes if they choose once financial arrangements have been made. All services will be restored and holds will be removed within 24 hours of payment in full. Please refer to the academic calendar for payment due dates.

- Collections: When a student is no longer enrolled: All past due debt may be referred to a collection agency. The debtor will be responsible for all collection costs, including agency fees, attorney fees and court costs, in addition to the original debt. Collection fees may increase your account balance by 25%. In addition, non-payment or a default judgment against your account may be reported to a credit bureau and reflected in your credit report.

- Tax Refunds: To collect past due debt Treasure Valley Community College may also request student's state tax refund from the State of Oregon Department of Revenue (DOR). If the College is receiving any payments from a tax refund, written notifications will be sent to the account holder.